Blog

Since days when shale oil and gas technologies were discovered, the U.S. energy industry has been evolving more rapidly than ever before. Many changes are amazing especially when you put them on an industry map. At Rextag not only do we keep you aware of major projects such as pipelines or LNG terminals placed in service. Even less significant news are still important to us, be it new wells drilled or processing plants put to regular maintenance.

Daily improvements often come unnoticed but you can still follow these together with us. Our main input is to “clip it” to the related map: map of crude oil refineries or that of natural gas compressor stations. Where do you get and follow your important industry news? Maybe you are subscribed to your favorite social media feeds or industry journals. Whatever your choice is, you are looking for the story. What happened? Who made it happen? WHY does this matter? (Remember, it is all about ‘What’s in It For Me’ (WIIFM) principle).

How Rextag blog helps? Here we are concerned with looking at things both CLOSELY and FROM A DISTANCE.

"Looking closely" means reflecting where exactly the object is located.

"From a distance" means helping you see a broader picture.

New power plant added in North-East? See exactly what kind of transmission lines approach it and where do they go. Are there other power plants around? GIS data do not come as a mere dot on a map. We collect so many additional data attributes: operator and owner records, physical parameters and production data. Sometimes you will be lucky to grab some specific area maps we share on our blog. Often, there is data behind it as well. Who are top midstream operators in Permian this year? What mileage falls to the share or Kinder Morgan in the San-Juan basin? Do you know? Do you want to know?

All right, then let us see WHERE things happen. Read this blog, capture the energy infrastructure mapped and stay aware with Rextag data!

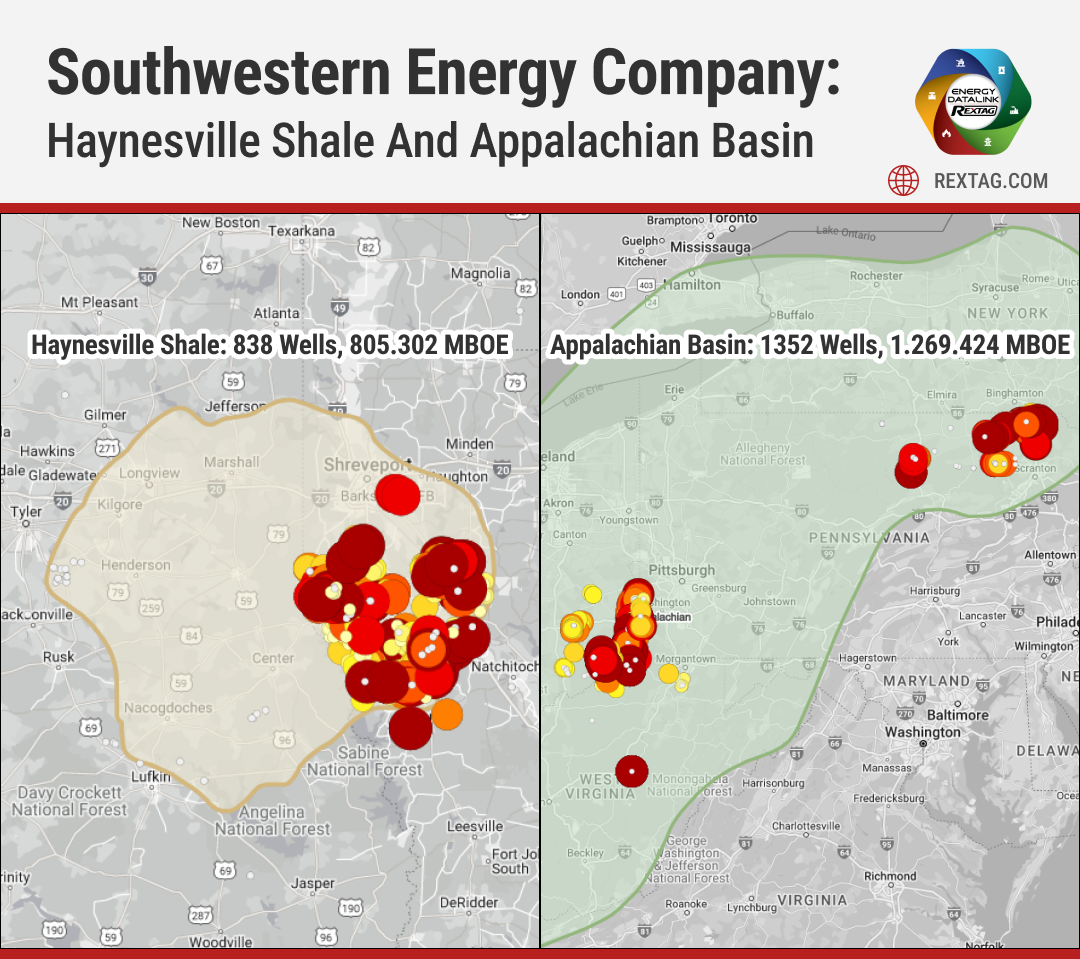

Southwestern Energy Company: M&A, 2022 vs 2023 Review, 2024 Forecast

Southwestern plans to keep its production steady, with a budget of $2.0 to $2.3 billion allocated for capital expenditures in 2024. This budget includes about $200 million for capitalized interest and expenses, which means the spending on drilling, completion, and other costs would be in the range of $1.8 to $2.1 billion to maintain a production level similar to 2023's output of approximately 4.57 Bcfe per day. The company anticipated closing 2023 with a debt of around $4.1 billion. Given the current market prices, Southwestern aims to reduce its debt to about $4 billion by the end of 2024, targeting a production level close to 4.5 Bcfe per day. Furthermore, the company has set a goal to lower its debt to under $3.5 billion. To reach the debt reduction target of approximately $3.5 billion by the end of 2024 or early 2025, Southwestern may need to adjust its capital expenditure budget to around $1.2 billion. This adjustment could lead to a slight decrease in production to about 4.2 to 4.25 Bcfe per day in 2024, representing a 7% to 8% reduction from the production levels in 2023.